Please Select

How Quaser turned a money-losing acquisition into a secret weapon

Story and Customers Voice

08/01-00/00, 2023

「By Ching Fang Wu / CommonWealth Magazine」

https://english.cw.com.tw/article/article.action?id=3478

It was a match made in heaven, but it resulted in a massive loss. Taiwan's Quaser Machine Tools acquired Britain's leading aerospace equipment manufacturer, Winbro—only to lose US$22.2 million over the pandemic. How did they come out of the storm?

Things look grim in the machine tools industry. However, Quaser Machine Tools (百德機械), a high-end machine tools company with a thirty-year history, is bucking the trend.

Ever since it turned a profit last year, Quaser reported revenue in June of this year that is the highest monthly revenue in four years. Its earnings for the first half of 2023 dropped only 3% year-over-year, which is miles above the competition. Chairman Samuel Hsieh (謝瑞木) says double-digit growth is not out of the question for its overall revenue this year.

If the going is getting better, it's because Quaser successfully weathered three years of losses after an international acquisition.

In October 2019, after two years of deliberation, the British high-end machine tools company Winbro Group Technologies was officially acquired by Quaser.

This was Quaser's first international acquisition. Little did anyone know that it would end up becoming an albatross around Quaser's neck.

Quaser CEO Startin Hsieh (謝天昕), who was the biggest proponent of the merger, thought of things this way: "It would be business as usual, since Winbro had always been a moneymaker." He is the son of Samuel.

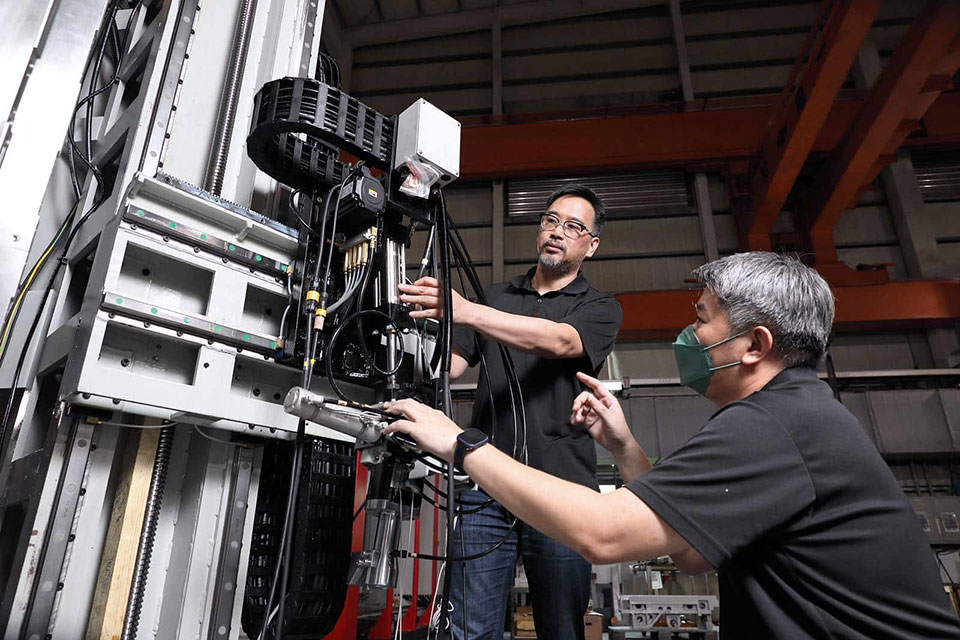

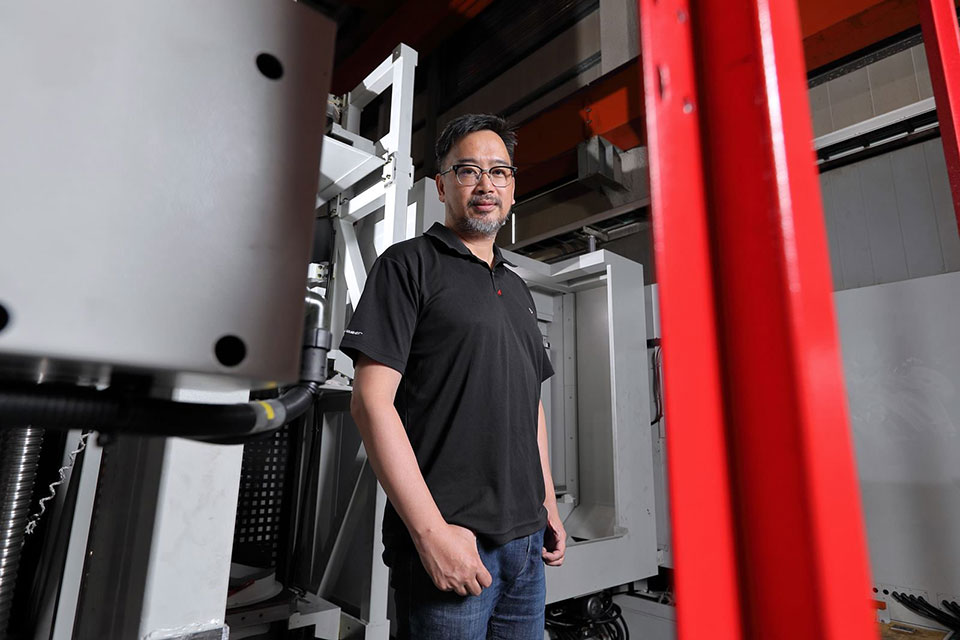

Quaser CEO Startin Hsieh (謝天昕) (Source: CommonWealth Magazine)

Hsieh started his career at Quaser as a maintenance engineer. He quickly rose to become the general manager of global sales. When he heard that Winbro was looking for a buyer, he sensed that this was a chance for Quaser to transform and upgrade its business.

With manufacturing sites in both the UK and the U.S., Winbro was initially Quaser's customer. Its flagship product was the 6-axis electrical discharge machining (EDM) hole-drilling machine, which could be used to puncture minute, needle-thin cooling holes in the turbine blades of airplane engines or electric generators. Airflow through the holes forms a protective shield over the blades and prevents them from melting due to the engine’s heat.

Counting Winbro, there were fewer than ten manufacturers in the world that made high-end machine tools that could be used to build turbines. More than 90% of Winbro's revenue came from the aerospace sector. For example, the aero-engine manufacturing arm of Rolls-Royce exclusively used EDM machines made by Winbro.

This was a proverbial "golden goose" that the younger Hsieh had no qualms about buying. How was he to know that two months after the deal was inked, a global pandemic would lead to lockdowns around the world and send the aviation industry into a tailspin?

The pandemic led to key players jumping ship

The cat was out of the bag. The golden goose was an albatross. Between 2019 and 2021, although Quaser made more than NT$100 million every year, the books showed that it lost almost NT$700 million due to the acquisition of Winbro. To make matters worse, at the height of the pandemic, both the CEO and CFO of Winbro announced their retirement.

In any acquisition, people are the most valuable assets. When Quaser and Winbro signed their prenup, they carefully laid out how long the senior managers were expected to stay on and how much they were to be compensated. The only thing that wasn't covered was what would happen if they decided to jump ship ahead of time.

"Because we thought we were sure to make money, no one planned for this contingency," says Hsieh. He was powerless to stop the old blood from leaving. As the virus raged on, the US$63.5 million that Quaser spent to acquire Winbro seemed as good as gone.

It was true that there were some who took a dim view of the merger even before it was finalized. This was the first time that the 32-year-old Taiwanese company had ever bought out another company. Not only was it out of its depth, the acquisition target was an older company in its own league: Winbro had half a century of experience in the aviation industry, and its staff was as big as Quaser’s. Its revenue was about NT$1.5 billion, which was only slightly below Quaser's.

Quaser had done outsourcing work for Winbro since 2012. In 2017, when word got out that Winbro was looking for a buyer, Hsieh fought to place a bid. Winbro was initially uninterested; but after shopping around for two years and getting offers from only venture capitalists and banks, its owners had a change of heart and entered negotiations with Quaser, which had the advantage of coming from a similar technical and managerial background.

“Winbro was selling because the owners were getting on in years and there was no one to take over the family business. Quaser wanted to buy because both the elder and younger Hsiehs knew transformation was inevitable.”

Since its founding, Quaser has always targeted the high unit-price, mid- to high-end European markets. Its specialty is the design and production of small- and medium-sized milling machines that are used for metal drilling and cutting. Quaser also does ODM work for tier-one Japanese machine tool clients.

Taiwanese machine tool brands feeling the squeeze

Before the merger, Quaser enjoyed an annual revenue of nearly NT$2 billion. Its scale in the milling machine sector was nothing to sneeze at; yet, the going was getting harder. Startin Hsieh observed that advancements in controllers and computers over the last decade had closed the gap in the craftsmanship of machine tooling products. This paved the way for the rise of Chinese and Korean competitors in this sector, and Taiwanese brands could no longer maintain the quality lead that they used to enjoy. The dip in the exchange rate for the Japanese yen also meant that pricey Japanese machine tools were suddenly competing in the same market as Taiwanese brands.

As profit margins shrank for Taiwanese companies, Hsieh started thinking: was there a way to widen the gap with competitors?

Quaser's goal was to move Winbro's aerospace production line to Taiwan. Not only would this lower costs, but it would also help Quaser sell to the aviation market in Greater China.

"Winbro was a step farther ahead of the industry; it was the right direction," says Chin-chieh Chan (詹金杰), CEO of Maxmill Machinery (仕元機械). The milling machine market was already a buyer's market. Quaser was correct to look for new added value through acquisition. Only, its timing was unlucky.

The pandemic alerted Hsieh to the fact that snapping up an international brand doesn't turn Quaser an international brand overnight. The loss of the chief executives was a clear warning sign.

Activating "survival mode"

To stem the loss of talent, Quaser sought to strengthen connection. It promoted two members of Winbro's core team to improve morale. It also hired a brand consultant to review its strengths and to redefine the brand spirits of both companies. Quaser also walked back its decision to have the headquarters in Taiwan call all the shots.

Now, a video conference is held between the headquarters and four top executives from the UK and U.S. every week, and a face-to-face meeting is held in one of the three locations every quarter.

Both sides are learning from each other. Whereas Quaser excels at mass production, Winbro is unrivaled in bespoke projects. The two sides are familiarizing themselves with each other's managerial language and finding a middle ground.

Even as it engages in building its brand and overhauling its corporate culture, the headquarters is also taking the lead by helping Winbro hunt for new customers in different markets during a period of history when the aviation sector is experiencing a downturn. "I call it 'survival mode'," says Hsieh.

Ultimately, an American client inquired about a component in the etching process used in semiconductor manufacturing that requires precise drilling. Winbro wound up completing the process in half the time that's usually needed, and with greater precision.

During the pandemic, machines for semiconductor manufacturing briefly became Winbro's primary product, making up over half of its source of income. Even now that the aerospace sector is recovering, semiconductor machines still make up 30% of Winbro's revenue, contributing a steady flow of cash to the company.

The past three years have not dampened Quaser's plan to become an international brand. Hsieh says there are upcoming investment projects in Croatia, Germany, and Poland.

Any new investment may incur losses, but Quaser has weathered the storm and reached clearer skies. Now, it has a more expansive source of revenue. "Machine tools have plateaued in Taiwan. One needs to do something different to bring about change," Hsieh said.